VoxChina ︳2018-04-26

http://voxchina.org/show-3-78.html

Trade disputes between the United States and China greatly intensified recently as the two countries announced a 25 percent tariff hike on $50 billion worth of products imported from each other, raising the risk of a trade war between the two giant trading economies. Based on a standard multi-sector, multi-country general equilibrium trade model with input-output linkages, we evaluate the cost of a trade war in which the United States and China both increase their tariffs to 45% for all imports from each other. We find that the United States would be more likely to be the bigger loser and that the cost for China would be moderate.

The world trade system has been facing grave danger in 2018 ever since U.S. president Donald Trump threatened a 25 percent import tariff on $50 billion worth of products from China, and China threatened to retaliate with a tit-for-tat tariff on imports from the United States. These two countries, which are the economic engines for the world economy and the largest exporters and importers in the world, are heading towards a high-stakes trade war. The risk of a U.S.-China trade war has significantly depressed global financial markets as increasing volatility has shadowed the economic outlook.

In our recent work (Guo et.al, 2018), we evaluate the possible impacts of a U.S.-China trade war on trade, output, and real wages by using a multi-sector, multi-country general equilibrium model with intersectional linkages. The model is an extension of Eaton and Kortum (2002), and the specific setting follows Caliendo and Parro (2015). The quantitative trade model provides a parsimonious approach to evaluating the quantitative consequences of changes in trade policy, and is an alternative to the traditional Computational General Equilibrium (CGE) model, which requires fully specified preferences, technology, and trade costs with many ad hoc parameters.

Our model covers 34 sectors in 62 economies including 34 OECD countries, 17 non-OECD emerging economies, and the rest of the world. We consider a hypothetical trade war in which the United States imposes a 45 percent import tariff for all imported goods from China. We choose this number because Trump proposed imposing 45 percent import tariffs during his meeting with the editorial board of The New York Times in January 2016. One important limitation of quantitative trade models is that a country’s aggregate trade balance (not bilateral trade balance) is usually exogenously determined by assumptions (Ossa, 2016). Countries with trade deficits receive a net income transfer from countries with trade surplus. For simplicity, we consider two possibilities: the trade war restores trade balance or maintains the current trade imbalance. The reality would be in between, but these two possible scenarios explain why the United States is at a disadvantage: it will lose the net income transfer from its current trade deficits if trade rebalances after a trade war.

We consider three possible scenarios of a U.S.-China tariff war in the model simulation. In the first scenario, the United States increases its import tariffs to 45 percent on all imports from China and all countries achieve balanced trade after the trade war. Balanced trade might well be one of the goals of a trade war as the U.S. government has for a long time blamed China for its large trade surplus. In the second case, we assume China retaliates by increasing its tariffs to 45 percent on its imports from the United States as well, again evaluating the impacts under the assumption of balanced trade. In the third case, we consider a situation in which both China and the United States impose 45 percent tariffs on each other, but trade imbalances remain unchanged for all countries. For simplicity, we name these three cases: 1) Unilateral U.S. tariffs with balanced trade, 2) U.S.-China reciprocal tariff war with balanced trade, and 3) U.S.-China reciprocal tariff war with pre-existing trade imbalance, respectively.

Our exercise shows that in all scenarios, high import tariffs lead to a catastrophic collapse in bilateral trade between the U.S and China. In the first case, China’s exports to the United States plummet upon the unilateral U.S. tariff hike, while the effects on U.S exports to China is rather moderate. In the second and third cases of a tit-for-tat tariff war, the bilateral imports between the two countries slump in all sectors, with half of the 18 sectors considered dropping by more than 90 percent. The collapse of bilateral trade is particularly pronounced in the sectors in which each country has a comparative advantage: U.S. exports of agricultural goods, wood, paper, and computers, and China’s exports of textiles and computer and electrical products.

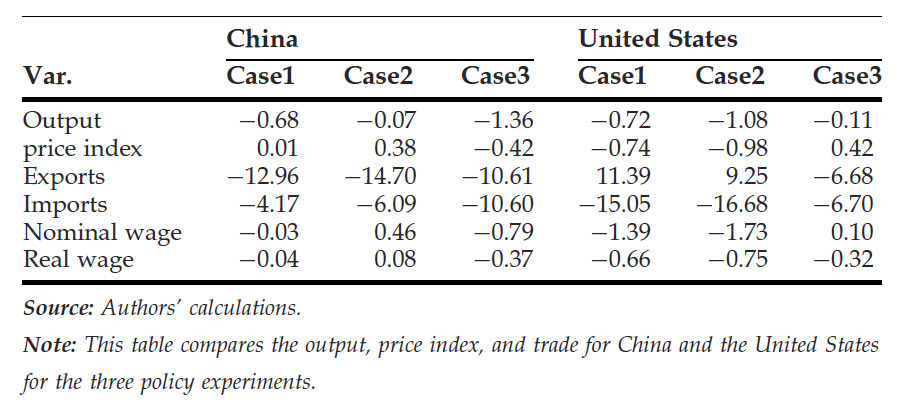

A U.S.-China trade war would generate substantial losses in output and social welfare measured as real wages. The United States is likely to be the biggest loser in all scenarios. In the worst case, its output and real wages would drop by 1.08 percent and 0.75 percent respectively (case 2 in Table 1). The losses for China in the first two cases with balanced trade would be very small. The comparison between the first two cases also indicates that China would be better off if it takes retaliation when the U.S. increases its tariffs against China. In the third case with unbalanced trade, China and the United States would experience similar losses in social welfare, i.e., the real wage in the two countries would decrease by 0.37 percent and 0.32 percent respectively (case 3 in Table 1). In all cases, some Asian countries may gain slightly from the trade diversion, while many advanced economies would experience collateral damage due to spillover effects through input-output linkages and general equilibrium effects.

The costs of a trade war are asymmetric for two reasons. First, the quantitative model itself is asymmetric in many settings including the technology level, bilateral trade costs, and labor endowments. Moreover, the sectoral composition of each country is different and the sectoral responses to tariff hikes vary due to the different substitution elasticities. In the third case where the trade imbalance remains, the real wage declines for both countries but the mechanisms are very different. China loses the U.S. market due to high tariffs, and thus the exports and outputs drop more, which leads to a decline in nominal wages. However, prices in China also decline as the country produces more for itself. The real wage drops because the nominal wage declines more than the price adjustment. In contrast, the United States imports less and thus the price level increases. The nominal wage slightly increases as the country needs to hire more workers to meet domestic demand. Overall, the real wage in the United States also declines, but the mechanism is quite different from that of China.

Second, the assumption about trade balance also plays a crucial role in the asymmetric costs of the potential U.S.-China trade war. Currently the United States has large trade deficits, indicating higher expenditures than income. Restoring trade balance implies that the country should reduce its expenditures and therefore consumption. This explains why, in the first two cases, the U.S. would be at a disadvantage, and China may gain slightly from the trade war if trade rebalances.

In the first two cases in which the trade war would lead to a trade balance, the United States must export more and import less to move from a trade deficit to a trade balance, while China would need to reduce its exports more than it would need to reduce imports (cases 1 and 2 in Table 1). In other words, the United States would have to reduce its consumption expenditures, which acts a negative income shock. In contrast, the reduction in China’s trade surplus acts as a positive income transfer to China, and thus would alleviate the negative effect of a trade war on its economy. Thus, in these two cases, social welfare loss would be even larger for the United States than China. However, if the trade war did not change the current trade imbalance, the United States would still spend more than its income, while China would consume less than its income. Thus, China may be hurt more than the United States by the trade war (case 3 in Table 1). However, this case is less likely to happen as a trade war would reduce the volume of trade, and thus the trade imbalance between two countries would be more likely to shrink. Moreover, our analysis implies that trade balance might not be a desirable target for the United States if it eventually triggers a trade war against China.

No one will win if two countries wage a trade war. Our calculation of welfare loss is rather conservative and likely to underestimate the effects of a possible trade war on outputs and social welfare. One key assumption in our model is that all economies function well without any other frictions, aside from trade costs, such as perfect labor mobility across sectors and financial frictionless. However, in reality, these adjustments may not be smooth, and the impact of a trade war on the world economy would be magnified. Moreover, a trade war is likely to trigger a tsunami in global financial markets, leading to a significant wealth loss.

The policy implication of our article is straightforward. China must consider how to deal with the enhanced trade disputes trigged by Trump. The best policy response would be to retaliate on the same scale against U.S. protectionist policies. More importantly, to guarantee that China is able to minimize its welfare loss, it is essential for China to simultaneously open up its domestic markets for China’s most important trading partners like the EU and the ASEAN 10 countries. Specifically, China can import more from the EU and the one-belt-one-road countries to reduce its domestic prices and hence increase real income.

(Meixin Guo, School of Economics and Management, Tsinghua University; Lin Lu, School of Economics and Management, Tsinghua University; Liugang Sheng, Department of Economics, the Chinese University of Hong Kong; Miaojie Yu, National School of Development, Peking University.)